British apple retailer of the year to be announced in September 2023

Farming unions have attacked the UK government's decision not to extend higher energy relief for intensive energy users including horticulture and poultry, warning that domestic food production will suffer.

Farming unions have attacked the UK government's decision not to extend higher energy relief for intensive energy users including horticulture and poultry, warning that domestic food production will suffer.

The Energy Bill Relief Scheme (EBRS) will close on 31 March, to be replaced in April by a new Energy Bills Discount Scheme (EBDS), which offers far less protection to businesses faced with soaring energy bills.

Some industries, including food processing and manufacturing, will be eligible for additional support for their energy bills under the Energy and Trade Intensive Industries (ETII) scheme.

However, chancellor Jeremy Hunt confirmed in his Spring Budget on Wednesday (15 March) that the government has excluded energy intensive farming sectors such as horticulture, pigs and poultry from the ETII scheme.

NFU president Minette Batters said hard-hit horticulture and poultry businesses had been striving to keep the nation fed while dealing with high energy bills and soaring costs.

British apple retailer of the year to be announced in September 2023

![]() British Apples & Pears Limited (BAPL) will start publishing monthly apple sales data on its website from February 2023.

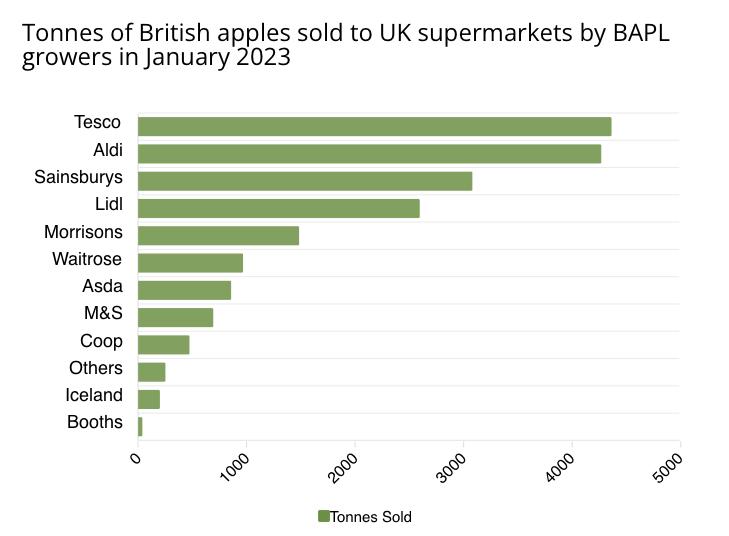

British Apples & Pears Limited (BAPL) will start publishing monthly apple sales data on its website from February 2023.

The data, aggregated from BAPL member returns, will show the tonnages of British apples harvested from the 2022 apple crop, sold by growers to British supermarkets. It will reveal which UK supermarket is buying the most British apples from UK growers.

![]() "British retailers say they want to support British, and this data will reveal those retailers that really are buying British." Explained BAPL executive chair, Ali Capper. "We know from previous data that Aldi, for example, sold more British apples than any other supermarket in the year ending July 2022. We are now well into the sales year for the 2022 British apple crop and with this new monthly data we'll have a much more current picture of British apple sales by supermarket."

"British retailers say they want to support British, and this data will reveal those retailers that really are buying British." Explained BAPL executive chair, Ali Capper. "We know from previous data that Aldi, for example, sold more British apples than any other supermarket in the year ending July 2022. We are now well into the sales year for the 2022 British apple crop and with this new monthly data we'll have a much more current picture of British apple sales by supermarket."

The monthly BAPL data will be aggregated at the end of the growing year (in late Summer 2023) to enable BAPL to announce its British apple retailer of the year.

"It's going to be fascinating to see which supermarket comes out on top this season," said Capper. "It's so important all our supermarkets get behind British farmers and our wonderful British apples. We know that consumers want British if at all possible. When we have such wonderful fruit available in good quantities, that will store well, there really is no reason to look overseas."

The first monthly UK apple sales data can be viewed at https://www.britishapplesandpears.co.uk/supermarket-sales-data.

New monthly sales data will be published in the third week of the following month. For example, February 2023 British apple sales data will be published during week commencing 20th March 2023.

British apple retailer of the year to be announced in September 2023

British Apples & Pears Limited (BAPL) will start publishing monthly apple sales data on its website from February 2023.

The data, aggregated from BAPL member returns, will show the tonnages of British apples harvested from the 2022 apple crop, sold by growers to British supermarkets. It will reveal which UK supermarket is buying the most British apples from UK growers.

"British retailers say they want to support British, and this data will reveal those retailers that really are buying British." Explained BAPL executive chair, Ali Capper. "We know from previous data that Aldi, for example, sold more British apples than any other supermarket in the year ending July 2022. We are now well into the sales year for the 2022 British apple crop and with this new monthly data we'll have a much more current picture of British apple sales by supermarket."

The monthly BAPL data will be aggregated at the end of the growing year (in late Summer 2023) to enable BAPL to announce its British apple retailer of the year.

"It's going to be fascinating to see which supermarket comes out on top this season," said Capper. "It's so important all our supermarkets get behind British farmers and our wonderful British apples. We know that consumers want British if at all possible. When we have such wonderful fruit available in good quantities, that will store well, there really is no reason to look overseas."

The English Apple Man Comments

While the apple sales data identifies the performance of each Supermarket and in the full data in the LINK below demonstrates each individual Supermarkets Apple sales data (in green) v Market share of grocery (in brown) and clearly indicates which Supermarkets are "out performing" the others, it does not show the price returned by each retailer to the grower!

So which Supermarkets return the best/worst financial return per tonne!

The first monthly UK apple sales data can be viewed at https://www.britishapplesandpears.co.uk/supermarket-sales-data.

New monthly sales data will be published in the third week of the following month. For example, February 2023 British apple sales data will be published during week commencing 20th March 2023.

Mothering Sunday British Apple & Pear Recipes

Click on: Apple & Pear recipes for Mothering Sunday

Eggs!

Egg farmers are reducing flock sizes or leaving the industry due to running costs making their businesses unviable, a farming industry body has warned.

The British Free Range Egg Producers Association (BFREPA) said many of its members were losing money due to high chicken feed prices and energy costs.

Farmers have called for a 40p increase for a dozen eggs to help meet costs.

But supermarkets said they were "constrained" by how much cost they could pass onto customers.

Farmers claim that despite the price of a dozen eggs rising by about 45p in the supermarkets since March, they've only received between 5p to 10p of that increase.

Ioan Humphreys, an egg farmer from Powys in Wales said in a social media video that supermarkets were "refusing" to pay farmers a "fair price" for their produce at a time when costs had "skyrocketed" with feed, electric and the price of new birds.

Empty shelves

GSCOP expert and former senior Asda buyer Ged Futter says the current supply shortages at UK supermarkets are down in large part to retailers' all-consuming focus on price at the expense of product availability.

There are no reports of shortages in France and Germany, and European shoppers have shared photos of fully stocked fresh produce aisles. The same cannot be said of British supermarkets.

The truth behind this contrasting situation is not difficult to find, even when hidden by statements blaming it all on the weather. Yes, the weather is a factor, but it is only one of the factors. The fact of the matter is UK retailers hedged their bets last year. They bet that they wouldn't need to use UK greenhouses for produce in January and February, yet again they put all their money on black and it landed on red.

I don't want to be seen as constantly bashing supermarkets. I want to highlight that over and over again they are making the wrong calls, and this is affecting the whole industry. The fight for the lowest price has meant that the wrong metrics are measured. Supermarket buyers are being told 'you can't accept any more inflation', 'you can't put your prices up' and then their finance departments are telling them 'you must hit your profit numbers, missing is not an option'.

Reshoring Food Supply in the UK, This excellent overview by my friend David Riccini

Below: Grubbing British Orchards

When Morris Chang the 91 year old founder of TWSC (Taiwan Semi Conductor) opened their new manufacturing plant in Arizona last year, he made a speech, declaring that 'globalisation was almost dead'.

When Morris Chang the 91 year old founder of TWSC (Taiwan Semi Conductor) opened their new manufacturing plant in Arizona last year, he made a speech, declaring that 'globalisation was almost dead'.

What's that got to do with fruit production in the UK? Bear with me.

Over the last 30 years, western manufacturing exported jobs to Asia, taking advantage of 'cheap' labour. China's economic miracle relied initially on western investment and the consequential (obligatory) transfer of technology.

The looming crisis over China's demographic, tensions over Taiwan, the Russian invasion of Ukraine, Covid, have changed the game. The World is not the same place today.

The new buzz is 'reshoring', bringing manufacturing jobs home, shortening and securing the supply chain, and holding on to those expensive technological developments.

According to CIPS (Chartered Institute of Procurement & Supply) an article claimed the UK is experiencing a 'Tidal Wave' of companies reshoring. While in the US, the Biden administrator has just signed 2 bills aimed at rebuilding American manufacturing industry, with 55% of company CEOs planning to further reshore operations in 2023.

Clever people are waking up and planning for an uncertain future, knowing that the era of cheap limitless supplies shipped across the world and stable global connections we've enjoyed for the last 30 years is fast coming to an end. Inflation is back and so are instability and insecurity.

Where are the clever CEOs of our British supermarkets? Thinking about tomorrow, not next year or the year after. Akin to Nero, they're watching idly, while the orchards burn.

Sorry to be so depressing!

![]() That is all for this week

That is all for this week

Take care

The English Apple Man